So, all you should do is you experience in your myGov account, you hyperlink the ATO, you click on your superannuation accounts, and you consolidate it into one. It is always that easy, Which gentleman was pretty joyful to are aware that it was so easy to just consolidate his 19 accounts.

So there may very well be what is actually called a binding Demise gain nomination. Now what that, as being the identify implies, you might be telling the fund "This is when I would like my super to go", and you'll find specific people you might be permitted to nominate, but it really lets you know that, you fill the form out, which will, the fund is then bound by that.

when we do head over to terrific lengths to be sure our ranking standards matches the fears of customers, we can't guarantee that each pertinent characteristic of the economic merchandise are going to be reviewed. We make each exertion to offer exact and up-to-day facts. having said that, Forbes Advisor Australia can't assurance the precision, completeness or timeliness of this website. Forbes Advisor Australia accepts no obligation to update any person regarding any inaccuracy, omission or modify in information within our tales or another details produced available to anyone, nor any obligation to furnish the individual with any further more facts.

when you are near retiring utilize the budget planner to estimate simply how much funds you hope to spend after you quit working. If you own your own private dwelling, a guideline is that you check here will require two-thirds (sixty seven%) of your respective pre-retirement profits to keep up the same typical of residing in retirement.

You can even accessibility your superannuation should you achieve your preservation age, remain Functioning and begin a changeover to retirement profits stream.

Your economic situation is exclusive and the services we critique will not be ideal to your situations. Forbes Advisor encourages viewers to seek impartial specialist tips from an authorised monetary adviser in relation to their own individual economic situation and investments prior to making any economical selections.

Incorporating the house as an asset check would necessarily mean a lot of people are instantly ineligible. nevertheless, There's two tiers of age pension payments for ‘renters’ and ‘homeowners’, which will allow renters to receive a bit far more on the age pension than people that already individual their own house.

Superannuation is money that is put apart in a super fund on your retirement. It is created up of: Payments from a employer

There's a whole lot to take into consideration when comparing expense alternatives concerning cash. danger and return objectives and asset allocation inside expense solutions could vary concerning funds and will be taken under consideration when comparing funds.

Keating is lauded for his purpose in setting up Obligatory superannuation. But his motives for resisting Labor’s latest modifications Solid his vision for that procedure in a far more questionable mild.

The assets exam to ascertain eligibility with the age pension does not, at this time, consist of the spouse and children residence. several Australian households in our capital towns are worthy of a lot of dollars, but had been bought for any whole lot fewer decades ago.

viewers of our tales should not act on any advice with no initial using acceptable steps to confirm the knowledge while in the tales consulting their unbiased economic adviser so as to verify whether the recommendation (if any) is appropriate, obtaining regard to their expense goals, fiscal circumstance and unique demands. furnishing usage of our tales should not be construed as expense information or possibly a solicitation to buy or offer any protection or solution, or to interact in or refrain from participating in any transaction by Forbes Advisor Australia. In comparing a variety of financial services, we are unable to compare each and every provider on the market so our rankings never represent a comprehensive assessment of a certain sector.

reader Graeme Troy’s rejoinder to Keating over the paper’s letters page: “anyone that has in extra of $three million in superannuation is just not performing it rough. the only real goal of superannuation for these types of folks is tax avoidance.”

you have got to specify how frequently you need to be paid and the amount of. you can find least yearly pension drawdown fees should you don’t want your pension to get rid of its tax-totally free status.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Elin Nordegren Then & Now!

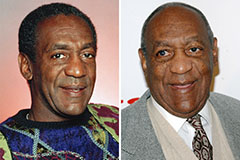

Elin Nordegren Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!